Before we get to it, I just wanted to let you know that I'm teaching my FREE Live Investing Class this Thursday evening. Save your seat here!

This is Rahel.

She is a 15 year old High school student who just got

a Summer job at a local café.

She works here for 3 summers and earns $5,000 every summer.

Her parents have been learning all about how investing early is the easiest way to build wealth.

So they tell Rahel that if she puts half of her summer income in a custodial Roth IRA, they would provide a 1-to-1 match of her contributions.

This means she could spend $2,500 a year as she wishes while getting the benefit of investing $5,000 a year (because of her generous parent’s match).

They decide to invest all of the Roth IRA contributions into a Total Stock Market Index Fund for diversification and growth. Historically the total stock market index has returned 10% a year on average for the last 75 years.

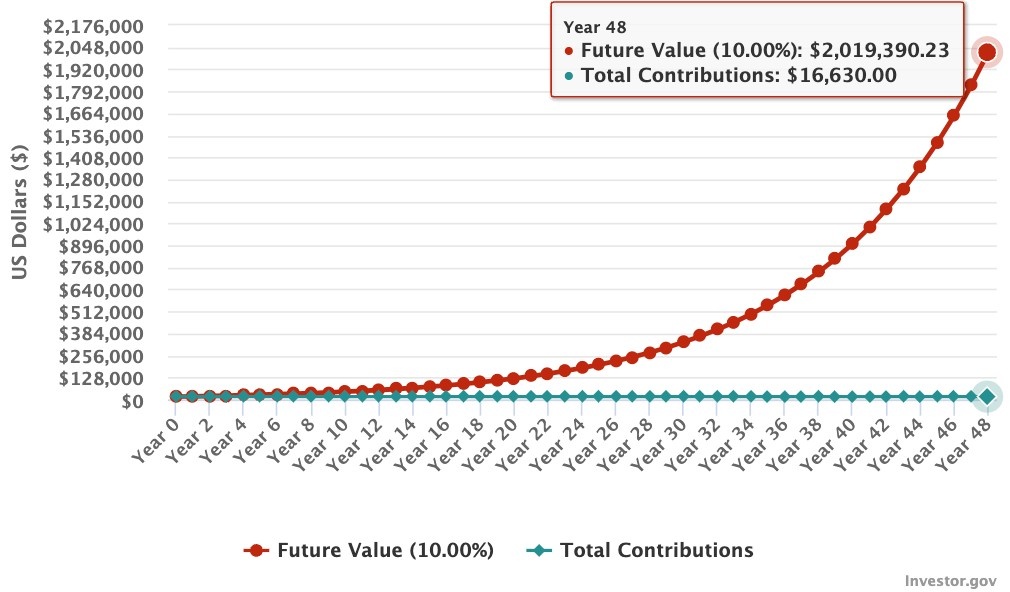

Because they started investing the first summer that she started working, by the time she is 17 her total $15,000 contribution has now grown to $16,630.

Rahel decides to stop contributing to that account when she is 17, but keeps it invested for the next 48 years (until she turns 65).

As Rahel grows older, she learns the power of investing when her (and her parent's) $15,000 contribution grows to over 2 Million by age 65.

Want to learn more about how to create generational wealth? Here are 27 lessons on Kids and Money you can start watching right now as a Wealth Club Member!

Not a Wealth Club member but want to learn? Start Here.

Mahi

PS: Any questions about this topic and anything else you've been learning inside the membership? Please ask away in the Wealth Community.

Black Womxn Are Wealthy has been featured in...