A Roth IRA is a tax advantage investment account where

- You contribute already taxed money

- Investments grows tax free

- You pay ZERO taxes when you withdraw

- You can withdraw ANY contributions at any time, penalty free

- You can withdraw the growth of your contributions after age 59.5

- The max you can contribute in 2026 is $7500. ($8600 if you are over 50).

Who can fully qualify to contribute to a Roth IRA?

Anyone who has taxable income whose modified adjusted gross income in 2026 is less than ...

- $153,000 as a Single or Head of Household filer or

- $242,000 as a Married Filing Jointly couple. (Or Married Filing Separately as long as you did not live with your spouse at any time during the year).

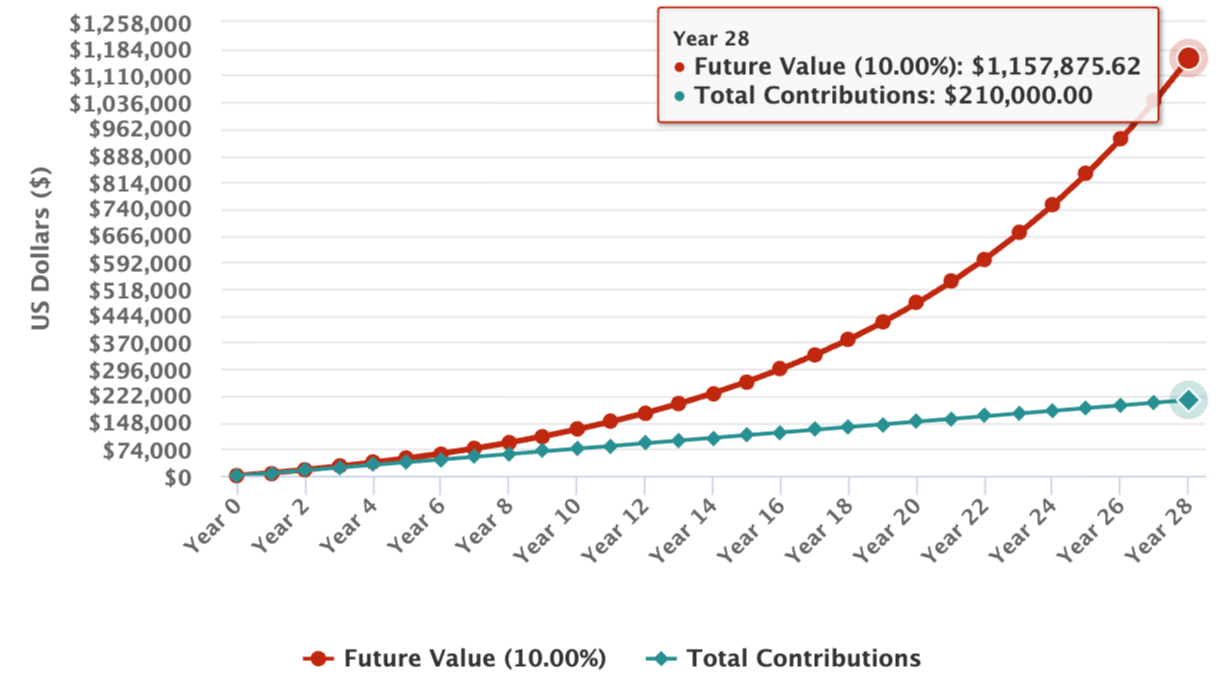

Let's say you decide to open a Roth IRA, contribute the maximum of $7,500 this year, and invest in an Index Fund that tracks the S&P 500 or the Total Stock Market.

Here is what could happen to the $7,500 you contributed and invested over time (without adding another penny).

Year | Investments

2026 $7,500

2033 $15,000

2040 $30,000

2047 $60,000

2054 $120,000

As you can see it will grow and double every seven years, since it's invested in an index fund that tracks a big portion of the stock market and stock market (in general) doubles about every seven years.

The $7,500 is now worth over 100K of tax free money after 28 years!

What would happen if you did this every year for 28 years?!

By investing $7,500 per year in a Roth IRA, in 28 years your Portfolio will have over a Million dollars of tax free money.

But Don't Forget One Very Important Thing...

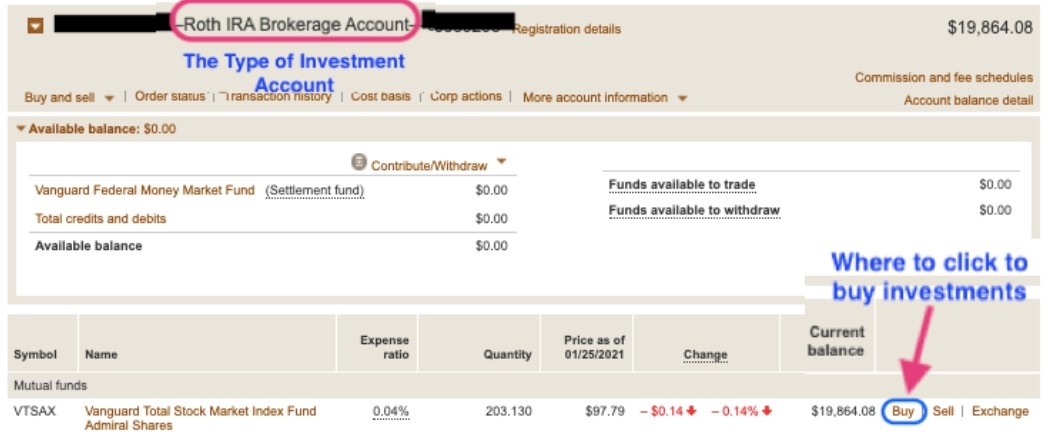

Investing in a Roth IRA (or any investment account) is a 2-Step Process.

Step 1: Make a contribution in cash.

Step 2: Then buy investments with that money inside the Roth Account.

For Example: Here is a Real Look Inside My Roth Account

Hope this Monthly Wealth Talk clarified any questions you have about Roth IRAs! If you are a Wealth Club Member you can find more information on Roth IRAs inside the club here and here! If you aren't a member but want to join, start here.

Mahi

PS: Any questions about this topic and anything else you've been learning inside The Wealth Club membership? Please ask away in the Q&A Forum of The Wealth Community.

featured in...